Organizations in California and somewhere else are watching out for approaches to set aside cash during these tight financial occasions. One phenomenal approach to reduce expenses is to exploit the corporate tax breaks accessible to California organizations from both the state and central governments. Albeit these duty motivations amount to an enormous decrease in numerous organizations’ duties, sadly numerous organizations are uninformed of them and neglect to exploit them and try the vrt calculator. This can be helped by working with a California corporate tax breaks expert now, rather than holding up until next April when it could be past the point of no return. Your tax break CPA will have the data you need about California charge impetuses that your partnership can utilize now to save money on your expense bill.

One part of corporate expense arranging that a CPA educated with these corporate tax breaks can assist with is to decide your organization’s qualification for Enterprise Zone credits and vehicle charge impetuses. The province of California has 42 Enterprise Zones, which are regions in the express that have been distinguished as being monetarily tested. Along these lines, the state urges organizations to set up organizations in these zones and recruit individuals living there to improve the nearby economy. At the point when organizations do this, they would then be able to profit by the various California charge motivating forces and Enterprise Zone credits accessible. These incorporate corporate tax reductions for employing individuals who are in sure assigned gatherings. They normally are on open help or are veterans; however certain classes of youth and others additionally qualify. In the event that your organization enlists one of these individuals who live in the Enterprise Zone and are in one of these uniquely assigned gatherings, your organization may get up to $13,000 per qualified representative every year as corporate credits. Sometimes, organizations with qualifying workers may document revised re-visitations of gain these corporate expense motivating forces for as long as three years already, or convey them over to one year from now if that is required.

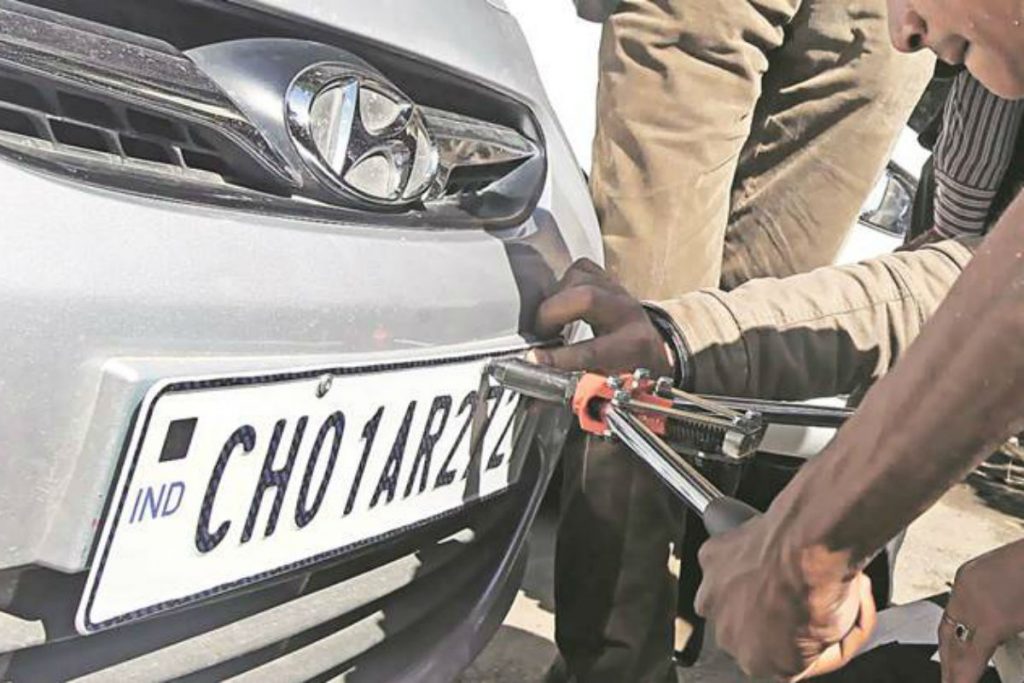

Your enterprise may likewise fit the bill for charge when it assists with dealing with the climate. Organizations that introduce power-creating gear that depends on sunlight based, geothermal and other sustainable assets may meet all requirements for tax cuts. On the off chance that your organization adds on contamination control and energy control gear to its arrangement, you may likewise get tax breaks for doing this. Utilizing elective fuel vehicles likewise qualifies. In the event that you essentially remember these guidelines when you give your vehicle, at that point your vehicle gift charge derivation will be guaranteed and you will have had a major effect to your altruistic association. All the more critically you will have the fulfillment of realizing you have helped somebody out of luck, and simultaneously be compensated with an assessment present from the IRS.